ETH Price Prediction: Navigating Short-Term Volatility with Long-Term Conviction

#ETH

- Technical Support Levels: ETH trading above 20-day MA at $4,088.76 provides near-term support, with Bollinger Bands indicating potential buying opportunities below $4,100

- Institutional Dynamics: Mixed signals with $422M institutional selling offset by significant accumulation from companies like SharpLink Gaming and Bitmine's $6.6B holdings

- Market Sentiment: Short-term bearish pressure due to profit-taking, but long-term fundamentals remain strong with growing institutional adoption and ecosystem development

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Near Key Support

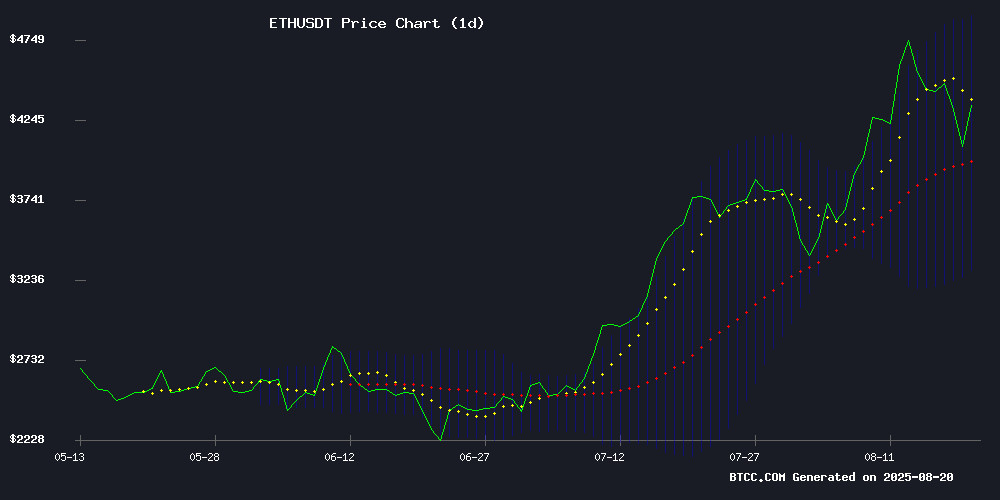

ETH is currently trading at $4,116.80, slightly above its 20-day moving average of $4,088.76, suggesting potential support at this level. The MACD indicator remains in negative territory at -86.34, indicating ongoing bearish momentum, though the gap between MACD and signal line has narrowed. Bollinger Bands show price trading NEAR the middle band with upper resistance at $4,884.14 and lower support at $3,293.38. According to BTCC financial analyst Sophia, 'The technical picture suggests consolidation around the $4,100 level with key support at the 20-day MA. A break below could trigger further selling toward the lower Bollinger Band.'

Market Sentiment: Institutional Selling Weighs on ETH Outlook

Recent headlines highlight significant institutional selling pressure with BlackRock and Fidelity ETFs dumping $422 million in Ethereum, contributing to the price decline to $4,063. Despite this selling pressure, SharpLink Gaming's $537 million purchase and Bitmine's substantial $6.6 billion ethereum holdings demonstrate continued institutional interest. BTCC financial analyst Sophia notes, 'While short-term sentiment remains bearish due to large institutional outflows, the underlying institutional adoption story remains intact. The market is experiencing typical profit-taking after recent gains, but long-term fundamentals remain strong.'

Factors Influencing ETH's Price

BlackRock, Fidelity ETFs Dump $422M Ethereum in Massive Selloff

Institutional investors are rapidly retreating from Ethereum, with BlackRock and Fidelity leading a $422 million selloff across their spot ETFs. The exodus marks one of the largest single-day outflows since these products launched, sending shockwaves through crypto markets.

Market data confirms the bleeding stems primarily from BlackRock's and Fidelity's ethereum ETF products. ETH's price has slumped to $4,179 amid the sell pressure, testing key psychological support levels. The scale of redemptions suggests a dramatic shift in institutional sentiment toward the asset.

Trading platforms report widening spreads and increased volatility as the sell orders hit the market. This institutional flight mirrors patterns seen during previous crypto downturns, though the concentrated nature of the ETF outflows presents unique liquidity challenges.

Ethereum Plunges to $4,063 as Institutional Giants Unload $422M in ETH

Ethereum's price tumbled to $4,063 amid a wave of institutional selling, with BlackRock, Fidelity, and Grayscale dumping $422 million worth of ETH in a single day. The sell-off marks the third consecutive session of outflows for spot Ethereum ETFs, raising questions about the sustainability of the asset's 200% rally.

Fidelity led the exodus with $156.32 million in withdrawals, followed by Grayscale's combined $210.58 million across its funds. Bitwise recorded $39.8 million in redemptions, while smaller players like VanEck and Franklin Templeton saw modest outflows. The three-day outflow total now stands at $678 million, reversing a month-long trend of positive inflows.

Liquidations accelerated as Leveraged traders were caught on the wrong side of the move. Market observers note the selling pressure comes despite growing institutional interest in Ethereum's ecosystem, with some predicting these same firms will re-enter at higher prices during the next uptrend.

Trader's $125K ETH Windfall Evaporates in Market Reversal

A trader who turned $125,000 into $29.6 million through aggressive Ethereum longs on Hyperliquid saw their fortune collapse overnight. After peaking at $43 million in account equity, the trader locked in $6.86 million profit but re-entered the market just as ETH's rally reversed. A $6.22 million liquidation left just $771,000 remaining—erasing four months of gains in 48 hours.

The episode underscores the double-edged nature of leveraged crypto trading. While Ethereum's recent rally created profitable exits for some, the subsequent pullback punished overexposed positions. Lookonchain data reveals the trader had built a 66,749 ETH position worth $303 million before the downturn.

Analyst Michaël van de Poppe suggests the correction may present accumulation opportunities for disciplined buyers. Market volatility continues to produce both spectacular gains and catastrophic losses in equal measure.

SharpLink Gaming Expands Ethereum Reserves with $537 Million Purchase

Nasdaq-listed SharpLink Gaming has significantly bolstered its Ethereum holdings, acquiring 143,593 ETH last week at an average price of $4,648 per token. The $537 million purchase was funded through a $390 million registered direct offering and $146 million raised via its at-the-market facility.

The firm's total ETH reserves now stand at 740,760 tokens, valued at over $3 billion. Since initiating its treasury strategy in June, SharpLink has earned 1,388 ETH in staking rewards. With $84 million remaining for additional acquisitions, the company continues to aggressively accumulate Ethereum despite trading at an 8% discount to its purchase price.

While now among the largest corporate holders of ETH, SharpLink still trails BitMine Immersion Technologies in total reserves. The MOVE underscores growing institutional confidence in Ethereum's long-term value proposition as a treasury asset.

Ethereum Dip Triggers Million-Dollar Losses for Traders Amid Broad Crypto Market Decline

Ethereum's recent downturn has inflicted significant losses on traders, with $196.8 million in positions liquidated—$155.15 million of which were long bets. The second-largest cryptocurrency by market cap slid 7.3% this week after reaching multi-year highs, now trading at $4,166.

Market-wide liquidations totaled $486.6 million over 24 hours, affecting 136,855 traders. One high-profile case saw a Hyperliquid trader's $29.6 million paper profit nearly evaporate within 48 hours after leveraging ETH positions.

The correction reflects broader weakness across digital assets, with major cryptocurrencies continuing their downward trajectory. Such volatility underscores the high-stakes nature of crypto trading, where leveraged positions can amplify both gains and losses.

BTCS Plans Historic ETH Dividend and Loyalty Bonus to Deter Short Sellers

BTCS Inc. is set to make history by becoming the first company to issue dividends and loyalty payments in Ethereum (ETH). Shareholders holding BTCS shares by September 26, 2025, will receive a $0.05 per share dividend, distributed via ETH wallets. Those who maintain their holdings until January 26, 2026, will earn an additional $0.35 per share, totaling $0.40 per share in ETH rewards.

The initiative aims to reward long-term investors while curbing aggressive short-selling. "This move empowers our shareholders and reduces the ability of their shares to be lent to predatory short-sellers," the company stated. BTCS Inc. ranks among the top five firms in Strategic ETH Reserve's 30-day aggressive ETH bids, holding 70,000 ETH worth $301 million at press time.

Despite ETH's recent price rally, BTCS stock has plummeted 45% since July, dropping from $8.50 to below $5. The contrast with BitMine (BMNR), the world's largest ETH treasury firm, highlights the market's divergent reactions to similar strategies.

Bitmine Becomes 2nd Largest Crypto Treasury Company with $6.6B Ethereum Holdings

BitMine, a publicly traded firm known for its aggressive treasury strategy, has solidified its position as the second-largest crypto treasury company globally. The company now holds 1.52 million ETH, valued at $6.6 billion—representing 1.26% of Ethereum's total supply. This milestone reflects BitMine's ambitious accumulation strategy, which aims to secure 5% of ETH's circulating supply.

The rapid growth of BitMine's Ethereum reserves—up from $4.9 billion just last week—signals strong institutional conviction in ETH's dual role as a financial asset and Web3 infrastructure backbone. The move mirrors early Bitcoin treasury strategies but pivots decisively toward Ethereum's expanding utility in the digital economy.

Ethereum Price Extends Losses – Is a Bigger Correction Underway?

Ethereum's price continues to slide, breaching key support levels as bearish momentum builds. The second-largest cryptocurrency by market cap now trades below $4,350, with the 100-hour moving average flipping to resistance. A descending trendline NEAR $4,350 reinforces the technical ceiling.

The latest downturn follows Ethereum's rejection at $4,580, mirroring Bitcoin's weakness across digital asset markets. Sellers have since pushed ETH below critical supports at $4,250 and $4,220, testing the $4,065 zone before minor consolidation. The 23.6% Fibonacci retracement level of the recent swing high to low now acts as immediate resistance.

Market structure appears fragile. Any recovery faces layered resistance at $4,185, followed by the 50% retracement near $4,320. The $4,020 support zone looms as the next potential downside target should current levels fail to hold. Trading volumes via Kraken reflect growing caution among participants.

Ethereum Faces Historic Short Interest Amid Volatility Spike

Ethereum's price slipped below $4,300 as volatility surged, testing bullish resolve after weeks of upward momentum. Institutional demand remains robust, with ETFs and treasury strategies fueling accumulation, but derivatives markets show escalating leverage battles.

Open Interest has reached record levels, reflecting intense speculation. Analysts note the largest leveraged short position in ETH's history, setting the stage for potential liquidations if prices rebound. The $4,500-$4,800 zone now serves as critical resistance.

SharpLink Expands Ethereum Holdings to Over $3 Billion in Assets

SharpLink Gaming has solidified its position as the second-largest corporate holder of Ethereum, amassing a treasury of 740,760 ETH—a $3 billion bet on the cryptocurrency's long-term value. The firm added 11,956 ETH in just four days, signaling aggressive accumulation amid market fluctuations.

This move reflects growing institutional confidence in Ethereum's ecosystem, particularly as LAYER 2 solutions and staking yields attract traditional finance players. The acquisition strategy suggests a bullish outlook despite recent volatility in digital asset markets.

Ethereum Slides Below $4,200 Ahead of Powell's Jackson Hole Speech

Ether extended losses to 5% on Tuesday, breaching the $4,200 support level as market participants braced for potential volatility around Federal Reserve Chair Jerome Powell's upcoming Jackson Hole symposium speech. The second-largest cryptocurrency has shed over 10% since last Thursday's hotter-than-expected PPI print triggered $1.1 billion in long liquidations.

Deribit data shows near-term implied volatility spiking to 73% while longer-dated measures remain subdued, reflecting traders' concentrated anxiety around the macroeconomic event. "All eyes are on Jackson Hole," said Deribit founder Nick Forster, noting the market's defensive positioning.

Technical factors compound the pressure - Ethereum faces headwinds from record validator exits and sustained outflows from ETH ETFs. The network's staking dynamics show unusual churn as the asset tests critical support at $4,100.

Is ETH a good investment?

Based on current technical and fundamental analysis, ETH presents a compelling investment opportunity despite short-term volatility. The current price of $4,116.80 represents a potential entry point for long-term investors. Technical indicators suggest support around $4,100, while institutional activity shows both profit-taking and accumulation.

| Metric | Value | Interpretation |

|---|---|---|

| Current Price | $4,116.80 | Near 20-day MA support |

| 20-day MA | $4,088.76 | Key support level |

| MACD | -86.34 | Bearish but improving |

| Bollinger Upper | $4,884.14 | Resistance level |

| Bollinger Lower | $3,293.38 | Strong support |

BTCC financial analyst Sophia emphasizes that 'while short-term headwinds exist from institutional profit-taking, Ethereum's fundamental value proposition as the leading smart contract platform remains robust. Investors should consider dollar-cost averaging and focus on the long-term adoption trajectory.'